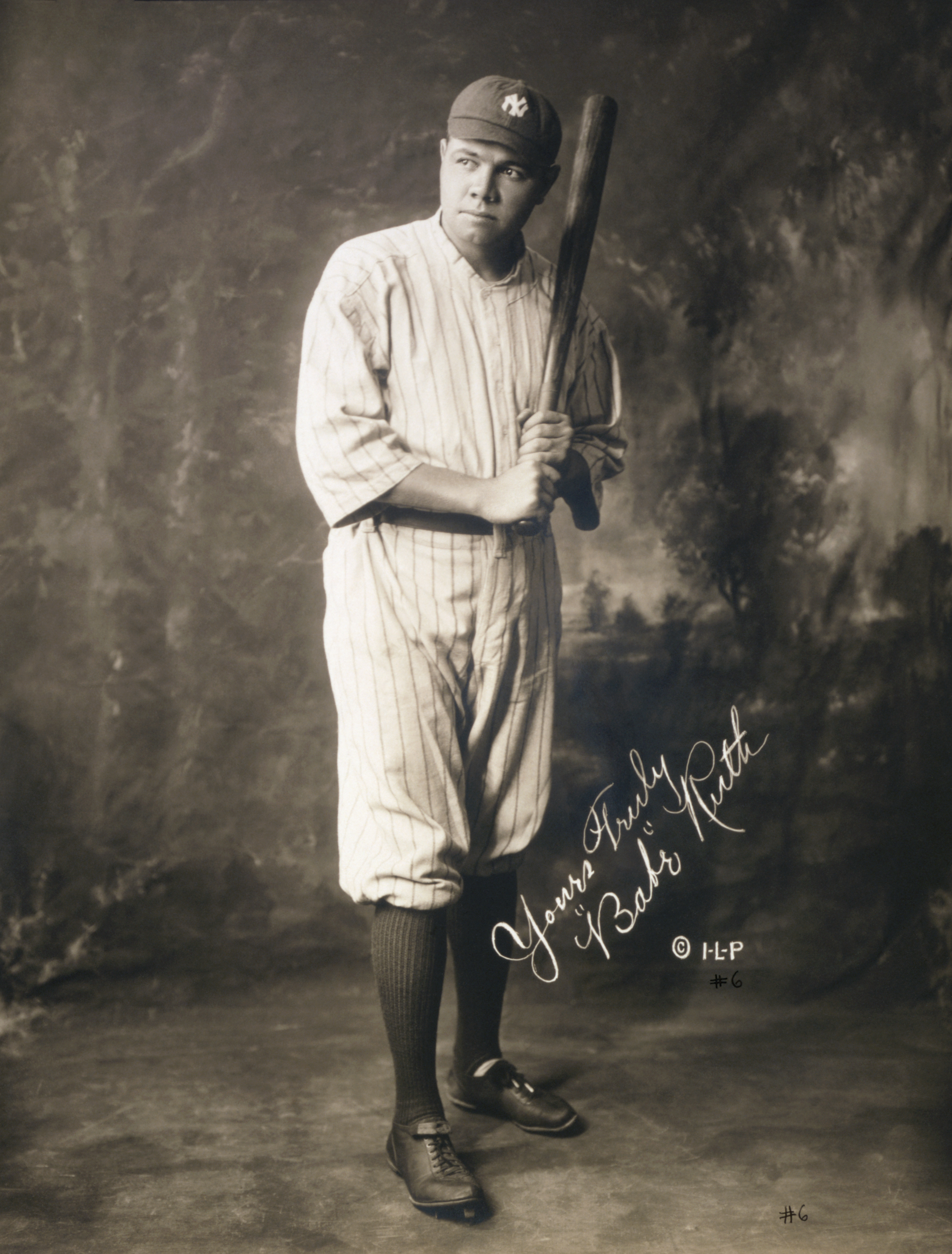

Last Will and Testament of Babe Ruth

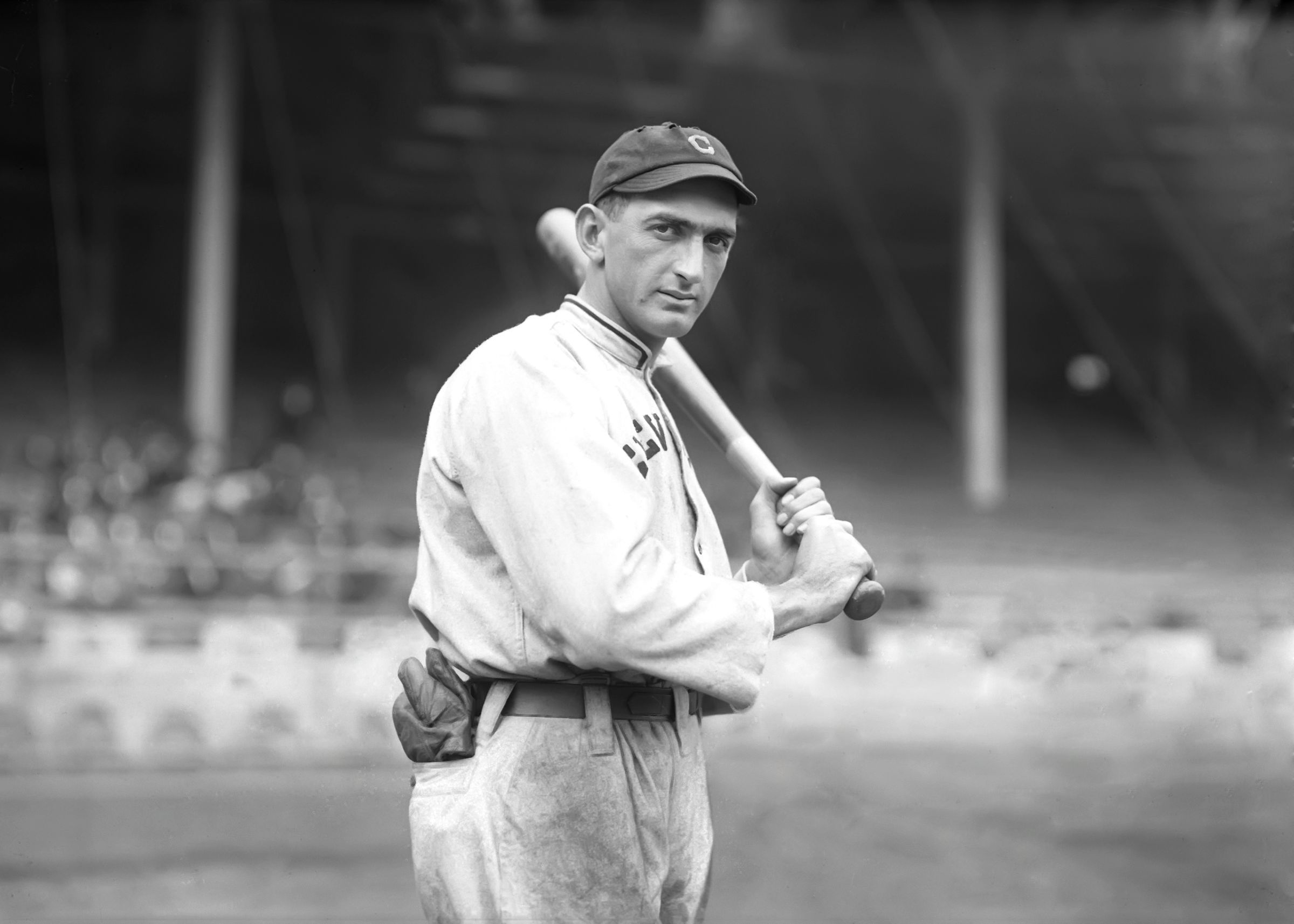

Babe Ruth

Born/died: (1895 - 1948)

LAST WILL AND TESTAMENT of GEORGE HERMAN RUTH I, GEORGE HERMAN RUTH, being of sound and disposing mind, memory and understanding, but mindful of the uncertainty of life, do hereby make, declare and publish this to be my Last Will and Testament, hereby revoking all other wills and codicils thereto be me at any time heretofore made. FIRST: I direct my Executors hereinafter named to pay all my just debts and funeral expenses as soon after my death as may be practicable. SECOND: I give and bequeath to my wife, CLARA MAE RUTH, if she shall survive me, all my household furniture, automobiles with the appurtenances thereto, paintings, works of art, books, china, glassware, silverware, linens, household furnishings and equipment of any kind, clothing, jewelry, articles of personal wear and adornment and personal effects, excepting however, souvenirs, mementoes, pictures, scrap-books, manuscripts, letters, athletic equipment and other personal property pertaining to baseball. In the event that my wife, Clara Mae Ruth shall not survive me, I direct my Executors hereinafter named to divide the said property between my daughters, DOROTHY RUTH SULLIVAN and JULIA RUTH FLANDERS, as my said daughters may agree, or in the event they are unable to agree, to divide the said property between my said daughters as my Executors hereinafter named may, in their absolute discretion determine. The determination of my Executors as to the relative values of such property for the purpose of dividing the same and in the making of such distribution shall be final, conclusive and binding upon all persons interested herein. THIRD: I give and bequeath to my Executors hereinafter named or either of them who may qualify, all my souvenirs, mementoes, pictures, scrap-books, manuscripts, letters, athletic equipment and other personal property pertaining to baseball, and I request but do not direct my said Executors to divide the same among such persons, corporations and organizations as I may from time to time request or in such manner as they in their sole and uncontrolled discretion may deem proper and fitting. FOURTH: I give and bequeath to my wife, CLARA MAE RUTH, if she shall survive me, to my daughter, DOROTHY RUTH SULLIVAN, if she shall survive me, and to my daughter, JULIA RUTH FLANDERS, if she shall survive me, each the sum of Five Thousand ($5,000.) Dollars. FIFTH: I give and bequeath to my sister, MARY H. MOBERLY, now residing in Baltimore, Maryland, if she shall survive me, the sum of Ten Thousand ($10,000.) Dollars. SIXTH: I give and bequeath to FRANK DELANEY, providing he is in my employ at the time of my death, and to MARY REITH, providing she is in my employ at the time of my death, each the sum of Five Hundred ($500.) Dollars. SEVENTH: Under the provisions of a certain Indenture or Trust Agreement made and executed by and between me and the President and Directors of The Manhattan Company of 40 Wall Street, Borough of Manhattan, City of New York, dated the 26th day of April, 1927, I reserved the right to designate in and by my last will and testament a new beneficiary to whom the income or principal of the trust fund which is the subject of the said Trust Agreement, shall be paid after my death in the place and stead of my daughter, Dorothy Ruth Sullivan, and my next of kin. Pursuant to such reserved right and in the exercise thereof, I hereby declare and direct that the income and principal of the said trust shall be paid after my death as follows: A. The income of the said trust fund shall be paid to my wife, CLARA MAE RUTH, during the term of said trust or the life of my said wife, CLARA MAE RUTH, whichever may be the shorter period. After the death of my wife, CLARA MAE RUTH, the income of the said trust during the remainder of the term thereof shall be divided equally between my daughters, DOROTHY RUTH SULLIVAN and JULIA RUTH FLANDERS. If JULIA RUTH FLANDERS shal be deceased, the income which she would have received had she been alive, shall be paid to her issue per stirpes and not per capita, or if there be no issue of said JULIA RUTH FLANDERS then living, all of the income of the said trust shall be paid to my daughter, DOROTHY RUTH SULLIVAN. B. Upon the termination of the said trust during the lifetime of my wife, CLARA MAE RUTH, I direct the Trustee thereof to purchase from an insuranc ecompany authorized to do business in the State of New York, a refund annuity which will pay to my wife, CLARA MAE RUTH, during her lifetime, in equal monthly installments the annual amount of Six Thousand ($6,000.) Dollars, and I further direct the Trustee of the said trust to divide the remainder of the principal of the said trust fund, including any refund payable upon the annuity hereinbefore required to be purchased for the benefit of my wife, CLARA MAE RUTH, into two (2) equal parts; and (1) To pay one of such equal parts to the issue then living of my daughter, DOROTHY RUTH SULLIVAN, or if she shall leave no issue then surviving, among such persons and in such manner as she may be her last will and testament direct; and (2) To pay the other of such equal parts to my daughter, JULIA RUTH FLANDERS, if she be then living, or if she be not living, to her issue then surviving, or if she shall leave no issue then surviving, among such persons and in such manner as she may by her last will and testament direct. EIGHTH: All the rest, residue and remainder of my property and estate, real, personal and mixed, of whatsoever kind, nature or description and wheresoever situate, of which I may die seized and/or possessed or over which I may have any power of disposition or to which I or my estate may be entitled, I give devise and bequeath to my Trustees hereinafter named IN TRUST NEVERTHELESS for the following uses and purposes: A. To collect and receive the rents, income and profits thereof and to pay the same to my wife, CLARA MAE RUTH, as long as she shall live. B. Upon the death of my wife, CLARA MAE RUTH, or upon my death, if she shall predecease me, I direct my Trustees to pay over, transfer, convey and deliver the principal then remaining in the said trust as follows: (1) Ten percent (10%) thereof to THE BABE RUTH FOUNDATION, INC., a corporation organized under the Membership Corporations Law of the State of New York and dedicated to the interests of the kids of America. (2) Forty-five percent (45%) thereof to my daughter, DOROTHY RUTH SULLIVAN, if she be then alive, or if she be not then alive, to her then surviving issue per stirpes and not per capita, or if she leave no issue then surviving, to such persons and in such manner as she may by her last will and testament direct. (3) Forty-five percent (45%) thereof to my daughter, JULIA RUTH FLANDERS, if she be then alive, or if she be not then alive, to her then surviving issue per stirpes and not per capita, or if she leave no issue then surviving, to such persons and in such manner as she by her last will and testament direct. NINTH: I nominate, constitute and appoint J. PAUL CAREY, II and MELVYN GORDON LOWENSTEIN, and the survivor of them, as Executors of and Trustees under this my Last Will and Testament. Within ninety (90) days from the date upon which one of the above named Executors or Trustees shall first act as sole Executor or sole Trustee of this my Last Will and testament, I direct him, by an instrument in writing duly signed and acknowledged and suitable for recording in the State of New York, to appoint a bank or a trust company which has conducted active business operations in the State of New York for at least 25 years, or which is the successor to a bank or trust company organized under the laws of the State of New York or the United States of America more than 25 years prior to the date of such appointment, to be and become a co-Executor and/or a co-Trustee. In the event that such sole acting Executor or sole acting Trustee shall not have appointed a bank or a trust company as co-Executor or Co-Trustee hereunder, as hereinabove directed and within the period hereinabove specified, then I nominate, constitute and appoint THE CHASE NATIONAL BANK OF THE CITY OF NEW YORK, as co-Executor and co-Trustee of this my Last Will and Testament. TENTH: I direct that if and when any part of the principal or income of any share or portion of my estate shall become payable to any beneficiary who is an infant, such principal or income shall absolutely vest in and belong to such infant, but payment thereof may be deferred, and I authorize my Executors and Trustees, as the case may be, in their sole and uncontrolled discretion, to hold the share of such infant and to retain the custody and control thereof and to administer the same and invest and reinvest such share or portion and the accumulated income therefrom, if any, with all the powers granted in this my Last Will and Testament to the Executors and Trustees, and my Executors and Trustees are further directed to apply such part of the income and principal thereof as in their discretion they may deem necessary and proper for the maintenance, support and education of such infant during minority, and upon such infant attaining majority, to pay over to such infant whatever part of such principal and income and any accumulated income thereon which may then remain in the hands of my said Executors or Trustees, as the case may be. Such application of principal or income, in the discretion of my said Executors or Trustees may be made wholly or in part by said Executors or Trustees paying directly the expenses for the maintenance, support and education of such infant, or by paying such principal or income to such infant or to an adult person of my Executors' or Trustees' selection deemed by them to be the most likely person to make proper application of such principal or income for the infant's benefit; the receipt of the person to whom such payment is made to be a sufficient voucher and discharge to my said Executors or Trustees, as the case may be, for all payments so made by them. ELEVENTH: In addition to the powers conferred upon my Executors and Trustees by law, or herein elsewhere conferred upon them, I hereby authorize and empower them and successors (a) to retain any investments which I may have at the time of my death, and to invest and reinvest any trusts funds coming into their hands in any stocks, bonds, securities or other property, real or personal, which they in their discretion deem advisable, whether such investments be authorized by the laws of any state or jurisdiction or not, and to hold the same as long as they may deem advisable, with full power to sell and reinvest, and to change securities and investments as they deem best; (b) for the purpose of partitioning or distributing the funds of my estate, and for any other purpose whatsoever, to grant, bargain, sell, convey, mortgage, lease, exchange, or otherwise dispose of, as and when they or their successors may deem expedient, any and all property, real, personal or mixed, of which I may be seized or possessed or in or to which I may be in any manner interested or entitled at the time of my death, or of which they may be seized or possessed, entitled to or interested in, as my Executors or Trustees, and upon such disposition thereof, to execute, acknowledge and deliver all necessary and proper deeds or instruments of conveyance for the vesting in the purchases, mortgagee, lessee, or other transferee thereof, the title thereto, in fee or otherwise, and I hereby direct that upon any such disposition thereof, my Executors or Trustees, or the successors of any of them, may take the consideration agreed upon, wholly or partly, in cash, stocks, bonds, notes or any securities which they or their successors shall determine upon, and I expressly direct that no purchases, mortgagee, lessee, or other transferee thereof shall be bound to see to the application of money or other thing of value paid or given therefor; (c) whenever my Executors or Trustees, or the successors of any of them, are required, or shall determine to divide the principal of my estate held by them into shares, so to divide the same without converting it into money, but in their discretion by apportioning the property held, whether the same shall be producing income or not, to such different parts or shares, in such manner as they shall deem fairly and equitably to bring about the division directed or determined upon, the judgment of my said Executors or Trustees concerning the priority of any allotment or distribution of property hereunder shall be final and binding upon all persons interested in my estate, and the determination of my Executors or Trustees as to the value of any such property shall be presumptively correct and shall be final and binding upon all persons in interest, unless clear and convincing proof is adduced showing gross error on the part of my said Executors or Trustees; (d) to consent to and participate in the reorganization, consolidation, merger or other capital readjustment of any corporation, the stocks, bonds or other securities of which they may hold, and to do all things whatsoever necessary, advisable or expedient to enable them to secure the benefits of such reorganization, consolidation, merger or other capital readjustment, including particularly the sale or purchase of any rights incident thereto, and the payment of any amounts necessary. Investments made through the exercise of any such rights, or the proceeds received at the sale thereof, shall be considered principal. I also further authorize my Executors or Trustees, as the case may be, to vote upon and give proxies to vote upon, any stocks or bonds of corporations that may be owned by me at the time of my death or subsequently acquired by them, upon any question that may lawfully be submitted to the vote of the stockholders or bondholders of such corporation, and in their discretion to subject any such stocks to voting trust agreements, and to accept voting trust certificates in exchange therefor. It is my will and intention that in dealing with the affairs and securities of any corporation in which I shall be interested at the time of my death, either as creditor or stockholder, or with the affairs and securities of any corporation in which my Executors or Trustees, as the case may be, may at any time be interested on behalf of my estate, as creditors or stockholders, my said Executors or Trustees, as the case may be, shall have and may exercise all of the powers that might lawfully be exercised by an individual owning said stock or obligation and acting in his own right and interest. The Trustees shall be authorized to hold such sum or sums uninvested as they shall see fit. The Trustees may hold the trust estate or any part thereof as an undivided whole, without separation as between the trusts hereby created, but no such holding shall defer the vesting of any estate in possession, or otherwise, according to the terms hereof. The Trustees are hereby authorized and empowered to employ such person or persons to assist them in the management and administration of the estate, in an advisory capacity or otherwise, as they shall deem in their sole discretion to be for the best interests of the trust estate and to fix and pay the compensation therefor. I direct that my Executors and Trustees shall not be required to lay apart any portion of the income or any of the said trust funds for the purpose of keeping the principal thereof intact, or for the purpose of making good any amount paid in premiums on the purchase of securities. |

Want to see more? Check out Clark Gable , Shoeless Joe Jackson , or Paul Newman 's will!

Head back to the list of famous wills.