Last Will and Testament of Linda McCartney

Linda McCartney

Born/died: (1942 - 1998)

LAST WILL AND TESTAMENT of LINDA LOUISE MCCARTNEY I, LINDA LOUISE McCARTNEY, a citizen of the United States residing at __________, declare this to be my Will, revoking all prior Wills and codicils. FIRST: I give my residuary estate, defined as the residue of my estate, real and personal, including lapsed gifts, after deduction of taxes and other charges to the extent provided in Paragraphs A and B of Article EIGHTH as follows: A. If my husband, JAMES PAUL McCARTNEY, survives me, I give my residuary estate to my trustees in a separate trust to be known as the qualified domestic marital trust. My trustees shall pay the net income of this trust at least quarterly to my husband from the date of my death and as long as he lives, and subject to Article SECOND hereof, my trustees shall also pay to my said husband such sum or sums from principal, up to the whole thereof, as my trustee who is an individual citizen of the United States or which is a domestic corporation deems advisable in his, her or its sole discretion. Upon my husband's death my trustees shall pay over the remaining principal of this trust in equal shares to such of my children, HEATHER LOUISE McCARTNEY, MARY ANNA McCARTNEY, STELLA NINA McCARTNEY and JAMES LOUIS McCARTNEY, as survive my husband, and to the issue then living of each of them who shall have predeceased my husband leaving issue then living, such issue to divide per stirpes the share the child of mine would have received if living. B. If my husband does not survive me, I give my residuary estate in equal shares to such of my children named in Paragraph A hereof who survive me, and to the issue then living of each of them who shall have predeceased me, such issue to divide per stirpes the share the child of mine would have received if living. SECOND: A. If the trust arising under Paragraph A of Article FIRST hereof is divided pursuant to Paragraph R of Article FIFTH into two or more separate trusts, I direct that any principal distributions to my husband shall be made first from the trust which my executors have elected to qualify for the marital deduction, and then from the trust which they have elected not to qualify for the marital deduction. Upon any such principal distribution to my husband, or upon his death, my trustees shall deduct from such payment or the remaining trust principal, as the case may be, and pay to the appropriate taxing authorities any estate tax, including interest and penalties thereon, payable by reason of such distribution, all in accordance with the provisions of the final paragraph of Article SIXTH hereof. B. The trustees of the qualified domestic marital trust shall at all times meet the requirements of Treasury regulations under the Code, if any, prescribed to ensure the collection of the estate tax imposed upon such trust, including without limitation any requirement that trust property be situated in the United States, that there be a trustee which is a bank or an institution with substantial United States assets, that a bond or other security for the payment of estate tax be furnished to the Internal Revenue Service, or that any returns, statements or other documents be filed with the Internal Revenue Service. THIRD: If pursuant to this Will any property, real or personal, and whether principal or income, becomes payable to a person who is an infant (defined for the purposes of this Will as a person under age twenty-one), I authorize my fiduciaries in their sole discretion to pay over such property in whole or in part at any time and from time to time to a parent or duly appointed guardian of such infant, to a custodian under a Uniform Gifts or Transfers to Minors Act (including my executors or trustees or any of them) who may act until such infant attains age twenty-one, or to any individual with whom such infant resides, for the use and benefit of such infant, or directly to such infant by way of an allowance or otherwise; or to cause my fiduciaries to retain such property as donees of powers in trust on behalf of such infant and to pay over the same to such infant upon his or her attaining age twenty-one or, in the event such person dies before attaining such age, to his or her estate. While such property is held by such donees they shall have with respect thereto all the powers of a guardian of such property appointed by a court and in addition all the powers conferred upon my fiduciaries hereunder, including without limitation the power to sell, mortgage or lease real property, and they are further authorized to pay over to such infant such part or all of the income and principal as such donees deem proper for the maintenance, support, health, education or welfare of such infant. Such donees may retain without judicial authorization commissions' at the rates of annual commissions allowed from time to time to testamentary trustees under the laws of the State of New York. I appoint my husband and my brother, JOHN LINDENER EASTMAN, to be the executors of and trustees under this Will. I authorize my said brother (and any individual successor to him) to appoint an individual or corporation to act as cotrustee with the then acting trustees, or to act as successor executor or trustee if for any reason he or she ceases to act prior to the complete administration of my estate or of the qualified domestic marital trust, as the case may be. At least one trustee of the qualified domestic marital trust shall be an individual citizen of the United States or a domestic corporation of the United States within the meaning of Section 7701(a)(4) of the Code or any successor provision thereto at all times during the administration of such trust. If at any time there is no trustee of the qualified domestic marital trust who is an individual citizen of the United States or a domestic corporation of the United States, notwithstanding anything contained herein to the contrary, the other trustee or trustees then acting shall appoint an individual citizen of the United States or a domestic corporation of the United States to act as a co-trustee of said trust. Except as otherwise specifically provided, the terms "executors" and "trustees" as used in this Will are intended to include the executors or executor and the trustees or trustee respectively acting hereunder from time to time. Such executors and trustees are sometimes referred to individually as "fiduciary" and collectively as "fiduciaries." Each appointment of a fiduciary in accordance herewith shall be by an acknowledged written instrument. Any such instrument may appoint one or more additional individuals or corporations as alternates to act in the event the individual or corporation first designated is for any reason unable or unwilling to serve. Any such designation may be withdrawn or altered by any individual empowered to make the same at any time prior to the occurrence of the vacancy it is designed to fill. Any such successor executor or trustee shall qualify by an instrument in writing signed, acknowledged and filed with the court having primary jurisdiction of my estate. No bond or other security shall be required in any jurisdiction of any fiduciary named herein or appointed as herein provided. No one of them shall be liable or responsible for the acts and defaults of any other, and none of them shall be required to file or render periodic accounts in any court. Any fiduciary may resign at any time without the permission of any court or person, by an instrument in writing signed and acknowledged by such fiduciary and filed with the court having primary jurisdiction of my estate. No fiduciary shall participate in the exercise of discretion with respect to the payment of income or principal, the termination of a trust, or the allocation of receipts and expenditures between income and principal, where a permissible beneficiary is either such fiduciary in an individual capacity, such fiduciary's spouse, or a person to whom such fiduciary in an individual capacity owes a legal obligation of support. If ancillary or separate administration of my property in any jurisdiction becomes necessary or desirable, I authorize my executors to be, or to designate an individual or a bank or trust company (including one or more of my executors) to be, ancillary executors or executor or to occupy such other fiduciary position as may be appropriate to accomplish this purpose under the law of such jurisdiction and I appoint the fiduciaries or fiduciary so designated; provided, however, that none of my said executors shall be entitled to dual commissions as my primary executor and as such fiduciary with respect to the same assets. The fiduciaries or fiduciary acting pursuant to this paragraph shall have, with respect to the property subject to such ancillary or separate administration, all of the rights, powers, privileges, discretions, exemptions and immunities granted to, as well as the duties and liabilities imposed upon, my executors by this Will, including exemption from bond and any requirement to file or render periodic accounts in any court, and upon completion of their administration they shall pay over the assets subject to their control to my executors. FIFTH: In addition to the powers provided by law, I authorize my fiduciaries in their discretion, until final distribution, and without applying to any court for permission or for instructions in regard thereto, as follows: A. To receive from any person, to retain and to invest and reinvest in any domestic or foreign stocks, bonds, mutual funds, common trust funds or other securities, and other real or personal property (including without limitation investments in general or limited partnerships or other forms of investment made in common with others including other fiduciaries), whether or not authorized by law for the investment of trust funds, regardless of any rule regarding diversity of trust investments; to invest in money market mutual funds or similar investment funds notwithstanding that a fiduciary hereunder may directly or indirectly manage or render services to such funds and receive compensation from such funds. B. To sell at public or private sale, grant options on, exchange or otherwise dispose of any property or any interest therein at such times and upon such terms and conditions, including credit and upon purchase money mortgages, as shall seem proper and to give good and sufficient instruments of transfer and to receive the proceeds of any such disposition. C. To manage, maintain and insure any property and to lease the same for such periods, irrespective of any statutory period otherwise applicable (all such leases to be in all respects binding upon all persons interested in my estate or in any trust), and on such terms., limitations and conditions, including provisions for renewals, as shall seem advantageous, and if advisable to pay for the value of any improvements made by a tenant under any such lease; to incur, extend or renew mortgage indebtedness; to make ordinary and extraordinary repairs and alterations to any building, to raze or erect buildings and to make improvements or to abandon any buildings or property; and to make any agreement of partition of such property and to give or receive money or other property in connection therewith. D. To exercise or sell all rights, options, powers and privileges, and to vote in person or by proxy, respecting any stocks, bonds or other securities, all as fully as might be done by persons owning similar property in their own right. E. To assent to, oppose and participate in any reorganization, recapitalization, merger, consolidation or similar proceeding, to deposit securities, delegate discretionary powers, pay assessments or other expenses and exchange property, all as fully as might be done by persons owning similar property in their own right. F. To organize or join with others in organizing a corporation under the laws of any jurisdiction for the purpose of acquiring any interest in property held hereunder, to convey to such corporation in exchange for its securities any such property or interest, to retain such securities as an investment, and to act as officers and directors of such corporation and be compensated therefor. G. To borrow money from any person or corporation, including a fiduciary hereunder, as may be necessary to pay taxes or to aid in the execution of any authority or power held hereunder, and to give notes for the sums so borrowed and pledge or mortgage any property as security therefor. H. To extend or modify any note or bond and mortgage held hereunder, to foreclose any mortgage or take title to the property secured thereby in lieu of foreclosure, and to protect any such property against forfeiture. I. To settle or compromise, by arbitration or otherwise, all claims. J. To register, transfer or hold any securities in nominee name or, to the extent permitted by applicable law, in bearer form or in the name or names of any other appropriate person, but with full responsibility therefor. K. To employ or retain such accountants, legal counsel, custodians and investment counsel and other agents and advisors, including any firm with which any fiduciary may be affiliated, as may seem advisable and to delegate authority thereto, and to compensate them from the funds of my estate or the qualified domestic marital trust, as the case may be; and specifically to employ a fiduciary or any of such fiduciary's affiliates to render brokerage or other services. L. To make payment from time to time on account of commissions and counsel fees without requiring the payment of interest and without obtaining security for repayment. M. To make an equitable division of any property and to pay over portions or undivided interests in cash or in kind (valued as of the date of distribution), and to cause any share to be composed of property different in kind from any other share. N. To pay over income or principal to any beneficiary by applying the same directly for the benefit of such beneficiary. 0. To pay from my general estate all reasonable expenses of the storage and delivery of tangible personal property. P. To determine whether to claim deductions available to me or to my estate on estate tax or on income tax returns. Q. To allocate any available exemption from the generation-skipping transfer tax under Section 2632 of the Code to any qualified property whether or not such property is included in my probate estate and to exclude any such property from such allocation. R. To divide the qualified domestic marital trust, prior to its initial funding, into two or more separate trusts on a fractional basis so that the federal generation-skipping transfer tax inclusion ratio for one or more such trusts shall be zero and such ratio for the other such trust or trusts shall be one, and so that my executors may elect to qualify one or more of such trusts for the federal estate tax marital deduction without electing to so qualify all such trusts; and to combine such trusts into one trust if at any time my fiduciaries in their discretion conclude that such division is no longer necessary. S. To delegate any duties or powers, discretionary or otherwise, to a co-fiduciary for periods and upon terms and conditions designated in a revocable written instrument signed and delivered to such co-fiduciary, except that no fiduciary may exercise through delegation any power from which such fiduciary is by law or the terms of this Will expressly excluded. T. To pay all necessary or proper expenses and charges from income or principal, or partly from each, in such manner as may seem equitable and compatible with Article SIXTH. U. To elect pursuant to Section 2652(a)(3) of the Code to treat me as the transferor, for purposes of the generation-skipping transfer tax, of all or any portion of the property includible in my federal gross estate that qualifies for the marital deduction pursuant to an election by my executors under Section 2056(b)(7) of the Code. No person dealing with my fiduciaries shall be required to inquire into the necessity or propriety of any transaction or into the application of any money or property paid or delivered. I understand the general rule of law (commonly referred to as the rule against "self-dealing" or as the rule of '$undivided loyalty") under which actions, decisions or transactions by a fiduciary are held to be void or voidable if the fiduciary is directly or.indirectly interested therein in his individual capacity. It is my firm belief that it will be in the best interests of the beneficiaries of the trust arising hereunder if my fiduciaries are free to perform their duties as fiduciaries hereunder without regard to such rule of law and I hereby specifically direct that my fiduciaries be allowed to perform their duties hereunder without regard to such rule of law. SIXTH: The gift for my husband under Article FIRST is intended to qualify for the marital deduction under the Code to the extent permitted by law and to the extent of my executors, election. Accordingly, the powers and duties, discretionary and otherwise, conferred upon my fiduciaries shall be exercised only in such manner as shall be consistent with the allowance of such marital deduction. The gift for my husband under Article SECOND is also intended to qualify as an "interest in possession" for the benefit of my husband for UK inheritance tax purposes. Accordingly, subject to the provisions of the first paragraph of this Article which shall have priority, the powers.and duties, discretionary and otherwise, conferred upon my fiduciary shall also be exercisable only in such manner as shall be consistent with there being such interest in possession. For the purposes of this provision the term "interest in possession" shall have the meaning it has for the purposes of Section 49 of the Inheritance Tax Act 1984 or any statutory modification or reenactment of such section. Except to the extent that other assets of my estate are not sufficient, there shall not be allocated to such gift any asset or the proceeds of any asset (A) with respect to which any death taxes are paid to any foreign jurisdiction, or (B) which does not qualify for such marital deduction. In the event that other assets of my estate are not sufficient to fund such gift in full, such insufficiency shall be satisfied by allocating the assets enumerated above in descending order of preference, no resort to be made to an asset of a subsequent group until all assets of the prior group are fully allocated. If any asset of the qualified domestic marital trust is so substantially unproductive of income as to deprive my husband of that degree of enjoyment of the trust which is contemplated by Section 2056 of the Code, then upon the written request of my husband my trustees within a reasonable time thereafter shall make the asset productive or convert it into other property which will produce an appropriate income. It is my intention that my husband shall be entitled to receive that degree of benefit from the trust which is requisite for the allowance of,the marital deduction. My husband shall have the exclusive right to the use and enjoyment of any real or tangible personal property at any time held in the qualified domestic marital trust and he shall be entitled to receive any rental income produced by such property. No payments of income or principal may be made from a marital trust to a child or more remote descendant of mine having an interest in the remainder thereof until after my husband has died. I direct that the determination of all inheritance, estate and similar taxes (but not generation-skipping transfer taxes), and any interest and penalties thereon, whether federal, state or foreign, attributable to any qualified terminable interest property passing to my husband by reason of my death which is includible in my husband's estate pursuant to Section 2044 of the Code or any comparable state or foreign statute shall be made in accordance with the procedure set forth in Section 2207A of the Code, unless my husband's Will makes specific provision otherwise. I direct that the taxes (including interest and penalties) attributable pursuant to Section 2056A of the Code to the qualified domestic marital trust upon distributions of principal or upon the death of my husband shall be determined and paid in accordance with said Section 2056A, unless my husband's Will makes specific provision otherwise. SEVENTH: If a qualified domestic marital trust should at any time appear to be of a size which my fiduciaries in their sole discretion believe would make it unnecessary or inadvisable to fund or continue such trust, the principal thereof shall be distributed outright to my husband. EIGHTH: A. I direct my executors to pay the expenses of my last illness and funeral, and to pay from the principal of the residue of my estate described in Article FIRST before any division thereof, all inheritance, estate or similar taxes (but not including generation-skipping transfer taxes), and interest and penalties thereon, payable to any jurisdiction in respect of any property includible in my estate for the purpose of determining the amount of such tax, whether or not passing under this Will, excluding, however, any such taxes imposed in respect of any trust that is includible in my estate for purposes of any such tax which shall be paid from such trust in accordance with the apportionment law of the State of New York in effect at my death, except as provided in the following paragraph. If at my death any property is includible in my estate for such tax purposes pursuant to Section 2044 of the Code or any comparable state or foreign statute, I direct that all such taxes of any jurisdiction, and interest and penalties thereon, attributable to such property shall be determined and recovered in accordance with the provisions of the instrument under which such interest arises. B. I direct that all generation-skippinq transfer taxes arising upon my death under Chapter 13 of the Code or under any state statute shall be paid in accordance with such Chapter or statute. C. Dividends and distributions received upon securities of corporations, associations or investment companies shall be allocated to income or principal as follows, notwithstanding any provision of law to the contrary: (I) if received in cash, or if receivable in cash at the option of the stockholder, to income. (II) If received in stock of the declarer or in any other security or property, to principal. (III) Notwithstanding the foregoing, if paid in whole or partial liquidation of the declarer, to principal. my fiduciaries shall resolve any doubt concerning the application of the foregoing directions and may fairly allocate between income and principal any receipt as to which provision is not made herein, and subject to Article SIXTH their decision shall be conclusive upon all persons interested in my estate or in any trust. D. If my fiduciaries invest in debt securities at a premium over par value, they shall not provide a sinking fund from the income of such securities to absorb such premium. My fiduciaries shall not treat as income any part of any profit realized upon the sale or redemption of any security acquired at a discount from par value, except in the case of securities customarily bought and sold on a discount basis. NINTH: A. A disposition of income or principal herein to the issue of a designated person shall be payable to such issue per stirpes, and such disposition shall be deemed to require a primary division into as many shares as there are children of such person either then living or represented by then living issue, regardless of whether or not there actually is a child of such person then living. B. A legally adopted child of any person, and such child's issue, shall be considered to be of the blood of such person for all purposes of this Will. C. In any proceeding relating to my estate or to the qualified domestic marital trust service of process upon any person under disability shall not be required if a party to the proceeding has the same interest. In any nonjudicial settlement of an account of my fiduciaries the execution of the instrument of settlement by all the persons upon whom service of process would be required in a proceeding for the judicial settlement of the account (after giving effect to the preceding sentence) shall bind all persons upon whom service of process would not be required to the same extent as that instrument binds the persons who executed it. D. I intend not to exercise by this Will any power of appointment. E. I intend not to make any provision herein for the benefit of any child or other descendant of mine, whether born before or after the date of this Will, except as herein set forth. F. References in this Will to the "Code" or other statute are to the Internal Revenue Code or such other statute as amended from time to time, and references to Chapters and Sections of the Code are to such Chapters and Sections and to successor Chapters and Sections thereto respectively. G. The decisions of my fiduciaries with respect to any discretionary powers granted by my Will and as to any questions that may arise hereunder shall be binding upon all persons. H. Each gift of tangible personal property under this Will is intended to include all copyright interests I may own at my death in such property. I. If any person including my husband who would be a beneficiary under any provision of this Will if he or she survives either me or some other beneficiary dies in such circumstances that it is difficult to determine whether or not he or she survived me or such other beneficiary, as the case may be, I direct that for all purposes of this Will such person shall be deemed to have predeceased me or such other beneficiary, as the case may be. TENTH: Even if I am not domiciled in the State of New York at the time of my death, I authorize my executors, in their discretion, to offer this Will for original probate in the proper Court either in an appropriate County of said State, or in such other jurisdiction within the United States as my executors deem appropriate, or in both should this be deemed advisable. Should my said Will be admitted to original probate in the State of New York, I direct and declare, pursuant to the authorization provided in New York EPTL 3-5.1(li), that it is my election that this Will and the testamentary dispositions herein contained (except as to real property not situated in New York) be construed and regulated in all respects as to administration, validity and effect by the laws of the State of New York. IN TESTIMONY WHEREOF, I, LINDA LOUISE MCCARTNEY McCARTNEY, have executed this Will, consisting of the seventeen preceding typewritten pages and this page, on 4 July 1996. The foregoing Will was signed by the testatrix and the undersigned in our presence together, on the day it is dated, and she declared it to be her Will and asked that we be attesting witnesses. Each of the undersigned, being duly sworn, deposes and says: The Will to which this affidavit is annexed was subscribed in our presence and sight at the end thereof by LINDA LOUISE McCARTNEY, the within named Testatrix, on the 4 day of July, 1996 at Hog Hill Mill Workhouse Lane Icklesham E. Sussex England. Said Testatrix at the time of making such subscription declared the instrument so subscribed to be her last Will. Each of the undersigned thereupon signed his or her name as a witness at the end of said Will, at the request of said Testatrix and in her presence and sight and in the presence and sight of each other. Said Testatrix was then over the age of eighteen years and, in the opinion of each of the undersigned, of sound mind, memory and understanding and not under any restraint or in any respect incompetent to make a Will. Said Testatrix, in the opinion of each of the undersigned, could read, write and converse in the English language and was suffering from no defect of sight, hearing or speech, or from any other physical or mental impairment, which would affect her capacity to make a valid Will. The Will was executed as a single, original instrument and was not executed in counterparts. Each of the undersigned was acquainted with said Testatrix at such time, and makes this affidavit at her request. The Will to which this affidavit is annexed was shown to the undersigned at the time this affidavit was made, and was examined by each of them as to the signatures of said Testatrix and of the undersigned. |

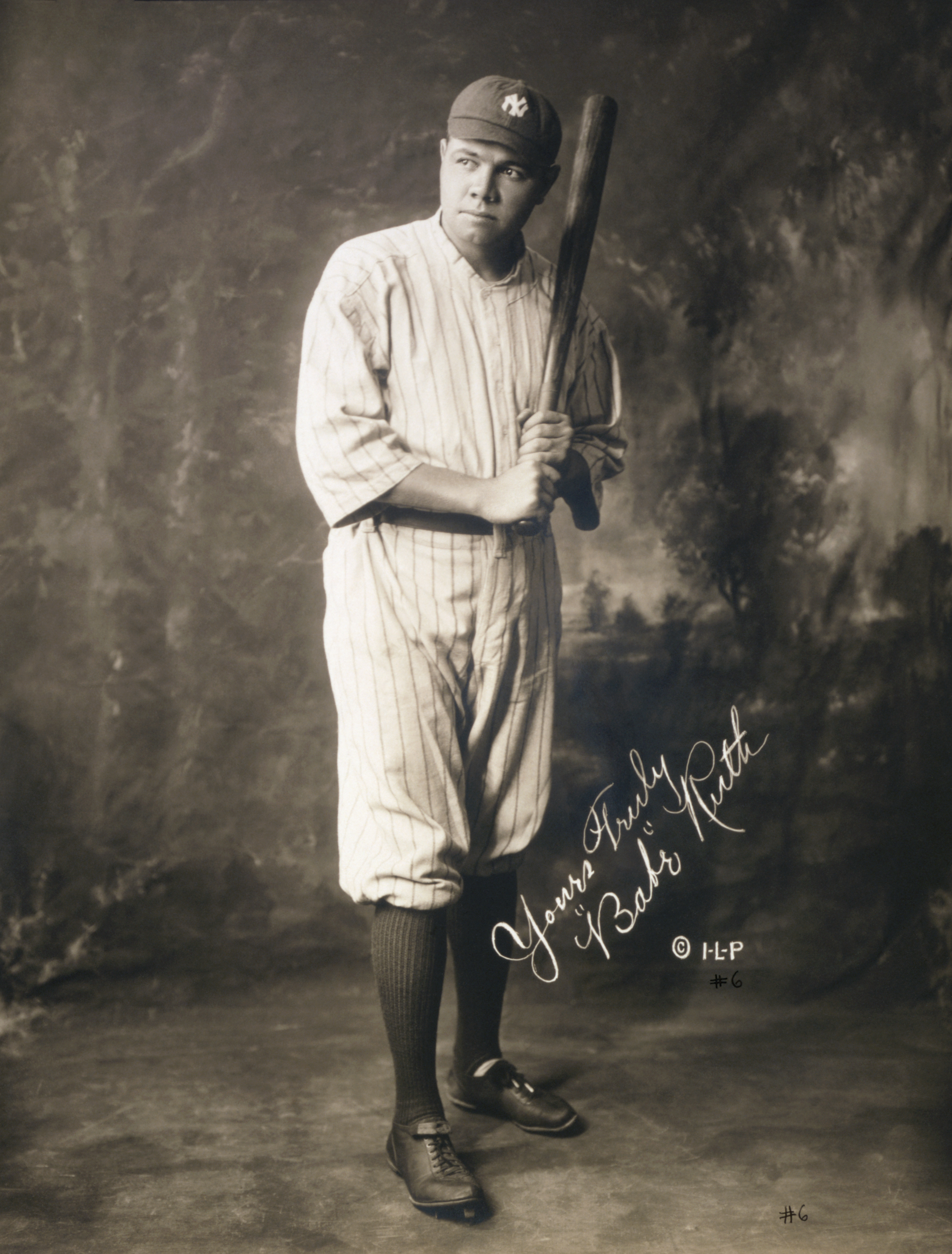

Want to see more? Check out Frank Sinatra , Paul Newman , or Babe Ruth 's will!

Head back to the list of famous wills.