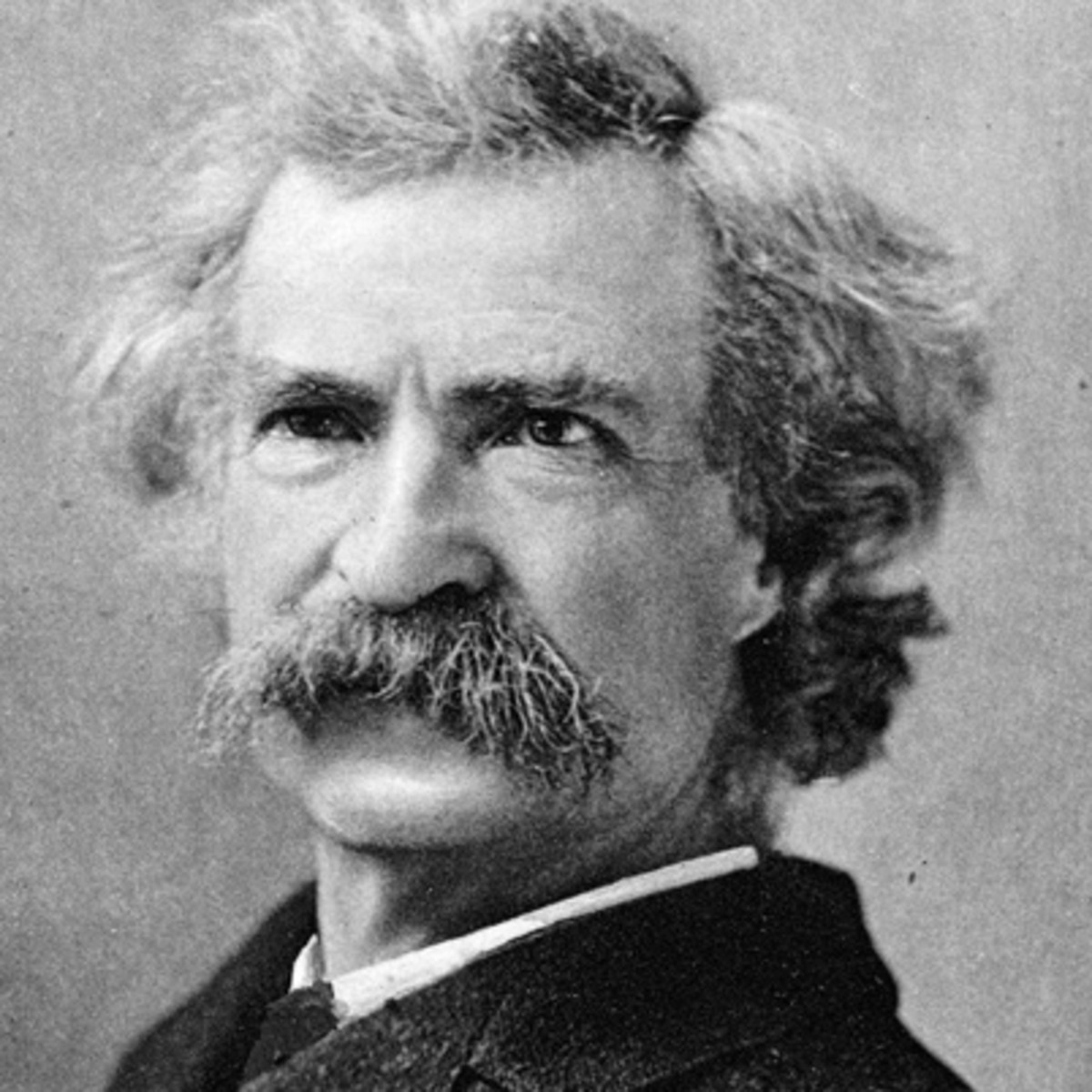

Last Will and Testament of Samuel L. Clemens

Samuel L. Clemens

Born/died: (November 30, 1835 - April 21, 1910)

|

LAST WILL AND TESTAMENT of SAMUEL L. CLEMENS I, Samuel L. Clemens, of the Town of Redding County of Fairfield, State of Connecticut, do hereby make, ordain, publish and declare this my last will and testament, hereby revoking all other wills and codicils by me at any time heretofore made. Article First I direct that my funeral expense and all my just debts and obligations be paid by my executors hereinafter named as soon after my decease as can conveniently be done. Article Second I give and bequeath to my daughter Clara Langdon Clemens, her heirs, executors, administrators and assigns absolutely five percent (5%) of any and all moneys which may at my death, be on deposit to my credit and subject to withdrawal on demand in any bank or trust company or in any banking institution. Article Third I give and bequeath to my daughter Jean Lampton Clemens, her heirs, executors, administrators and assigns absolutely five percent (5%) of any and all moneys which at the time of my death may be on deposit to my credit and subject to withdrawal on demand in any bank or trust company or in any banking institution. Article Fourth I give, devise and bequeath all the rest, residue and remainder of my property and estate, real, personal, and mixed, wheresoever situate to my executors hereinafter named, in trust however, for the following uses and purposes; to wit: I direct such trustees to divide said rest, residue and remainder into two (2) equal parts as nearly as may be, and to hold and dispose of the same as follows: (a) To invest and reinvest, one of such two (2) equal parts and to pay the income therefrom on the fifteenth days of January, April, July and October of each year to my said daughter Clara Langdon Clemens for the term of her natural life, to and for her sole and separate use and behoof, without power of anticipation, and free from any control or interference on the part of any husband she may have. Power is hereby conferred upon my said daughter Clara Langdon Clemens to dispose by last will and testament of the whole or any part of the said share or proportion of my residuary estate so held in trust for her sole and separate use, and my trustees hereinafter named are hereby authorized, empowered and directed to convey, assign, transfer and deliver the whole or any part of the trust fund hereby created for the benefit of my said daughter Clara Langdon Clemens as directed by her should she die leaving said last will and testament except as hereinafter provided. In the event that my said daughter Clara Langdon Clemens having married, shall die leaving issue her surviving but without leaving any last will and testament then and in that event the said half of my residuary estate held as aforesaid by my trustees for her sole and separate use, with any unpaid accumulations thereon, I give, devise and bequeath to her issue then surviving share and share alike (per stirpes) and not (per capita). In the event that the said Clara Langdon Clemens shall die without leaving issue her surviving and without leaving any last will and testament, then and in that event I direct that my trustees hereinafter named shall hold the said one half of my residuary estate for the sole and separate use and benefit of my daughter Jean Lampton Clemens under the same terms and conditions, and under the same trusts as hereinafter provided for the said Jean Lampton Clemens in subdivision ? b- of Article Fourth of this my last will and testament. (b) To invest and reinvest one of two such equal parts and to pay the income therefrom on the fifteenth days of January, April, July and October of each year to my daughter Jean Lampton Clemens for the term of her natural life to and for her sole and separate use and behoof without power of anticipation and free from any control or interference on the part of any husband she may have. Power is hereby conferred upon my said daughter Jean Lampton Clemens to dispose by last will and testament of the whole or any part of the my residuary estate so held in trust for her sole and separate use, and my trustees hereinafter named are hereby authorized, empowered and directed to convey, assign, transfer and deliver the whole or any part of the trust fund hereby created for the benefit of my daughter Jean Lampton Clemens, as directed by her should she die leaving said last will and testament, except as hereinafter provided. In the event that my said daughter Jean Lampton Clemens having married shall die leaving issue her surviving but without leaving any last will and testament then the said half of my residuary estate held as aforesaid by my trustees for her support, use and benefit with any unpaid accumulations thereon, I give, devise and bequeath to her issue then surviving share and share alike (per stirpes) and not (per capita). In the event that my said Jean Lampton Clemens, having married shall die leaving issue her surviving but without leaving any last will and testament, then the said half of my residuary estate, held as aforesaid by my trustees for her support, use and benefit with any unpaid accumulations thereon, I give, devise and bequeath to her issue the surviving share and share alike (per stirpes) and not (per capita.) In the event that the said Jean Lampton Clemens shall die without leaving issue her surviving or leaving any last will and testament, then I direct that my trustees hereinafter named shall hold the said one half of my residuary estate for the sole use and benefit of my daughter Clara Langdon Clemens under the same terms and conditions and under the same trusts as are hereinafter provided for the said Clara Langdon Clemens in sub-division (a) of article fourth of this my last will and testament. (c) In the event that either of my said daughters Clara Langdon Clemens or Jean Lampton Clemens shall by will or otherwise become entitled to the whole or any part or portion of the share of my residuary estate left by this instrument to the other, my said trustees hereinafter named shall continue to hold the same in trust, and I direct that my said trustees shall invest and reinvest the same and pay the income therefrom to such daughter on the fifteenth days of January, April, July and October of each year during the life of such surviving daughter, and upon her death to convey, assign, transfer and deliver the same to her executors, administrators and assigns to be disposed of by them, as she may by last will and testament direct; in the event that such surviving daughter shall not leave a last will and testament disposing of all the property held in trust for her benefit then I direct that my said trustees shall convey, assign, transfer and deliver all of the property then held in trust under the terms of this will to the next of kin of such last surviving daughter in accordance with the statutes of descent and distribution of the State of which such surviving daughter may be a resident at the time of her decease. Article Fifth -a- I hereby nominate and appoint my friends Jervis Langdon of the City of Elmira County of Chemung and State of New York, Edward E. Loomis of the City, County and State of New York, and Zoheth S. Freeman of the City, County and State of New York as the executors of this my last will and testament and trustees of the several trusts herein created, and reposing confidence in their integrity, I desire that they shall not be required to furnish any bond or other security as such Executors or Trustees and that if any Court administering upon my said Estate shall nevertheless require any such bond or security, the same shall be obtained at the expense of my estate, and the costs thereof paid out of the gross income thereof or out of the fund for the proper care or administration of which such bond or security may be acquired. Each of said Executors and Trustees shall have one vote in the determination of all questions affecting the administration of the said estate, or of said trust and the majority vote of said Executors or said Trustees shall settle and determine every question. -b- I give and grant to my Executors and likewise unto my said Trustees full power and authority to sell at private sale and to grant bargains and convey from time to time, all or any part of portion of the real estate and personal property herein devised and bequeathed or purchased with the proceeds or income thereof, for the time being in their hands or under their control or that may in any other way become a part of my trust estate, either for cash or upon such time and terms of sale and such security if any as to them shall seem best; further for the purpose of paying my just debts or satisfying any bequest or devise contained in this will, or for the purpose of any of the partitions or dividends, herein provided for or otherwise or for the purpose of investing or reinvesting or for any other purpose or purposes that they may think necessary or desirable to accomplish for the benefit of the estate, said Trustee shall have full power and authority to exchange any such property for other property, and generally to manage and control the same and all avails, produce and reinvestment of the same in the same manner and with the same authority, that they might manage and control their individual property, and I hereby grant to confer upon said Trustees full power and authority to invest and reinvest any and all moneys, avails and profits derived from any such property sold or exchanged in such securities and in such manner as in their discretion they may deem best, notwithstanding any provision of law requiring the investment of trust funds in any kind or class of securities, provided only, that the moneys, avails and produce derived from any property sold or exchanged as aforesaid, and all property and securities purchased or acquired by means of such moneys avails or produce shall be held in the same manner and upon the same trusts as the money invested or the property so sold or exchanged. I direct that in all cases all profits or losses incurred in the sale of securities or property belonging to the trust estate shall be added to or deducted from the trust estate, and shall not be credited to charged against the income account but all stock dividends and the value of all rights to subscribe to new securities of any corporation in which the trust estate is interested shall be considered income. All inheritance or transfer taxes shall be paid out of the corpus of my estate and not charged against the income. Article Sixth Upon the death of any of the Trustees herein before named or their successors, prior to the termination of their trusts, the survivors of said Trustees or their successors may, by instrument in writing duly acknowledged and recorded in the office where this will may be probated, appoint a successor to such trustee or to his successor. If such appointment is not so made within six months after such death, the Court having jurisdiction in the premises, may appoint such successor on application of any beneficiary hereunder. A successor trustee appointed by either method shall have all the power and authority conferred by this will upon his predecessor. Article Seventh As I have expressed to my daughter Clara Langdon Clemens, and to my associate Albert Bigelow Paine, my ideas and desires regarding the administration of my literary productions and as they are especially familiar with my wishes in that respect, I request that my executors and trustees above named confer and advise with my said daughter Clara Langdon Clements and the said Albert Bigelow Paine as to all matters relating in any way to the control, management and disposition of my literary productions, published and unpublished, and all my literary articles and memoranda of every kind and description and generally as to all matters, which pertain to copyrights and such other literary property as I may leave at the time of my decease. The forgoing suggestion as to consultation is, however, made subject to my contract dated July 24th 1909 with Albert Bigelow Paine for the preparation of my letters for publication, and in full recognition thereof, and subject also to the contract dated Aug 27 1906 made by and between the said Albert Bigelow Paine and Harper Brothers, as I have appointed the said Albert Bigelow Paine as my biographer, and have ratified and approved his said contract relating to the publication thereof. In witness whereof, I have hereunto subscribed my name and affixed my seal this seventeenth (17) day of August in the year of our Lord One Thousand Nine Hundred and nine.

|

Want to see more? Check out Anna Nicole Smith , James Gandolfini, or Marilyn Monroe's will!

Head back to the list of famous wills.

.jpg)